Monthly budget planning movie#

Instead, invite them over for a movie and popcorn.

Great! Now you can look at using some of that “extra” to pay off credit card debt or to add money toward your short- and long-term savings goals.

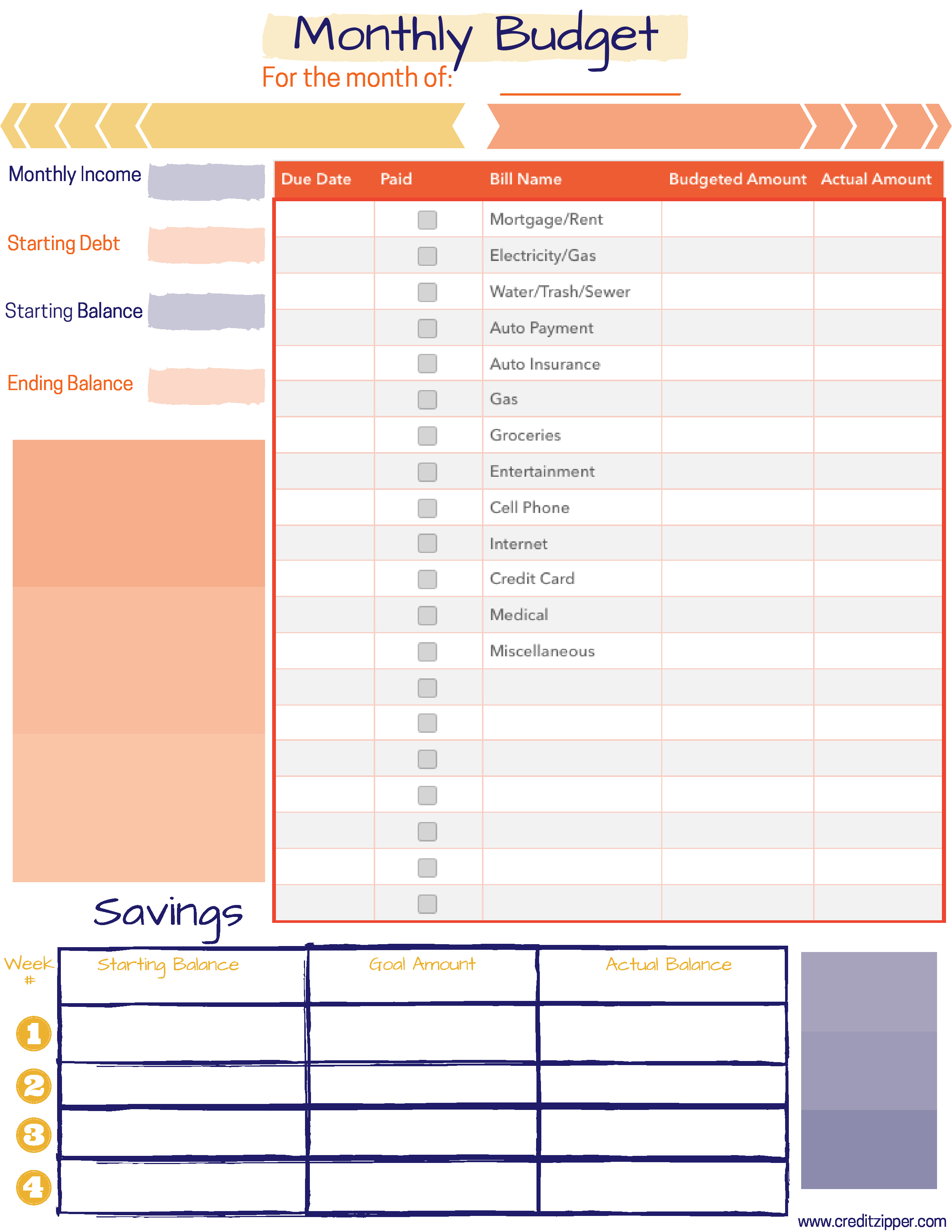

You’ll come up with one of three results: Saving is easiest when it’s a built-in part of your monthly budget.Īdd up your income and all your listed expenses. Last, but definitely not least, add in an amount for short-term and long-term savings.Typical costs of the “little” things like that daily latte or buying lunch out.An amount for unforeseen expenses like a car repair or an appliance replacement.For example, entertainment, dining out, dry cleaning, groceries, parking and gifts. The average cost of purchases that typically occur each month but can vary from month to month.The average monthly cost of expenses that you pay quarterly, semiannually or annually, such as car insurance, property taxes or some utilities.All payments that you make on a monthly basis, such as rent or mortgage, utilities, your car payment and other expenses.Start by listing your net monthly income - be sure to include all sources of income - and your known monthly expenses. Step 1: Identify monthly income and expenses You can get started in just a few easy steps. Once you understand your monthly spending habits, you’ll be able to make adjustments and empower yourself to save for the future.Įstablishing a monthly budget is a basic financial practice that can help you meet your monthly commitments as well as put you in good shape to save money.

Find a financial advisor or wealth specialist.Helpful information from the Consumer Literacy Consortium. Living On A Budget - Tips and Resources.Your budget will likely change over time depending on your salary and financial goals.īudget worksheet from the Federal Trade Commission. It is important for you to track your progress and review your budget frequently. Using whatever system works for you (online app or website, envelope system, excel spreadsheet, paper budget), create a budget.įind areas where you can cut back and find areas where you can fund your short term and long term goals. Long-term goals, such as saving for retirement or your child's college education, are goals that will take years to accomplish. Short-term goals, like saving up for a vacation, should take a year or less. You should make a list of both short- and long-term financial goals you want to accomplish. Setting your goals will determine your success in planning and keeping a budget. Then, list your variable expenses, such as dining, entertainment, travel, groceries and other expenses that vary from month to month.įinally, add in other expenses, such as taxes and insurance, which may be billed annually, semi-annually or quarterly. These are expenses that stay the same each month. You should include your full-time job and any other income sources, like income from rental properties or dividends.īegin by listing all of your fixed expenses, such as mortgage or rent, car payments and student loan payments. The first step in starting a budget is finding out how much money you make in a month.Ĭalculate your net income, which is your final, after-tax take-home pay. A budget is a planning tool to help you determine how you will spend your money.

0 kommentar(er)

0 kommentar(er)